Platform

Don’t get stuck paying more taxes than you need to.

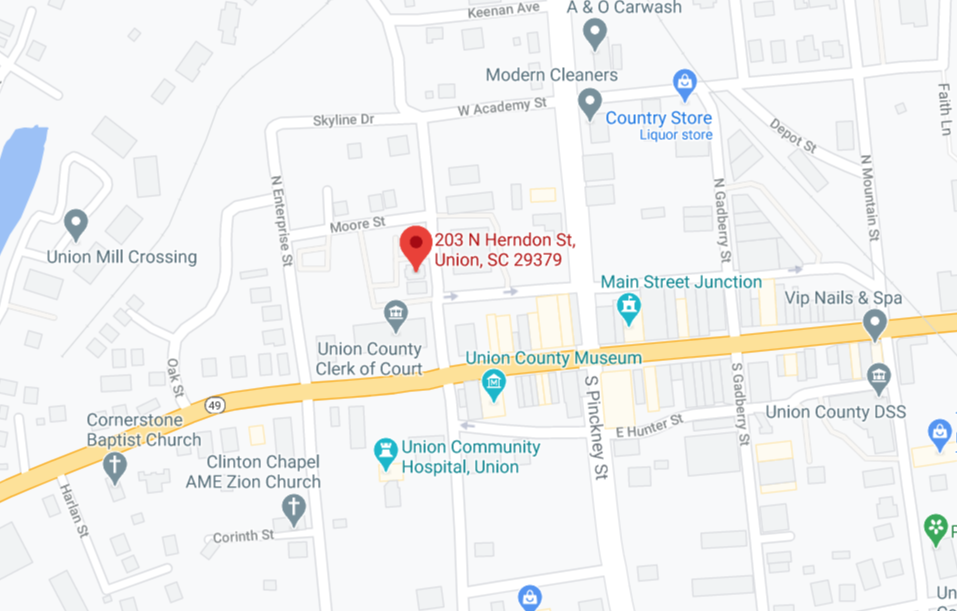

If you are occupying your home as a primary residence you are entitled to the 4% owner occupied rate. However, when your ownership was recorded with the county, they automatically assess at the higher non-owner occupied rate of 6% until you apply and prove it’s your primary residence.

Once you have received your recorded deed back from your closing attorney (usually 60-90 days after your settlement date), take it and a copy of your driver’s license reflecting property address, and your application for primary residence to the tax assessor’s office.

Depending on the county, additional information may be required. For your convenience we have compiled a reference list below. Please check these sites, or contact the assessor’s office, for the most current requirements and applications available.

And, as always, please call us if we can assist you in any way.

.png)

.png)

.png)

.png)